Is There Really an AI Bubble? What NVIDIA's Earnings Actually Tell Us

Over the last few days, the Q3 NVIDIA earnings report spurred some dramatic gyrations in the stock market.

First, let’s put the earnings in perspective. Yes, chip sales are very strong. NVIDIA beat estimates of EPS by $0.04 per share, $1.30 vs. $1.26 forecast, about 3% better than expected. That’s a big achievement, but it’s not quite the drastic spike some news headlines at the time implied.

Why the fervor? It comes at a moment when talk of an AI bubble has reached a cacophonous crescendo, so some of the hype around NVIDIA’s guidance comes from the apparent juxtaposition of strong earnings for an AI chip and hardware maker against a lot of doomsday mutterings.

But the trillion-dollar question is: does the NVIDIA earnings report mean there’s no AI bubble?

The anatomy of an AI bubble

To dig into that, let’s first talk bubbles. A bubble happens when a certain category of asset becomes overvalued (say, in this case, AI stocks), and some sort of pressure on a weak point in the business model forces that bubble to burst, driving prices sharply down in what economists euphemistically call a ‘correction’ and people pawing at their Robin Hood app refer to as “Oh crap.” In other words, we need two things to have a bubble: overvaluation, and some lurking weakness that will force this overvaluation to light when a certain event happens. In truth, these are interconnected—the weakness is the reason the valuation is too high—but you could have a weakness with an appropriate valuation and it wouldn’t lead to a bubble. In the case of the real estate bubble, the lurking weakness was bad loans that would eventually come to default, threatening solvency for the institutions that held them in portfolios.

So does AI have the necessary ingredients for a bubble? The weakness here is often seen as unsustainable spending relative to revenues: overhyped capabilities, aggressive infrastructure builds and murky connections to increased revenue. Many giants are currently operating at massive losses. For example, even with projected revenues of 2.2 billion, Anthropic (maker of Claude) is forecast to lose billions in 2025 and doesn’t expect to be profitable until 2027. That might sound like a long time, but it’s a pretty short runway when you consider the newness of the category. I’d expect their investors are prepared for this runway and intend to see it through. Anthropic has also focused more heavily on business use cases than some competitors, which is a smart long-term play. Businesses are ultimately the stronger revenue source. OpenAI (maker of ChatGPT), by contrast, doesn’t expect to be profitable through 2029, and has focused more heavily on making a splash with consumers, though their partnership with Microsoft is a step toward changing that. A longer runway carries more risk long-term, and consumer markets tend to be a little less predictable than B2B. So, the potential for a bubble is there, especially for those with longer runways and less clear paths to revenue.

The NVIDIA earnings report doesn’t actually negate the risk of a bubble. NVIDIA makes money selling chips, which are purchased very early in an AI development project—selling pickaxes for the gold rush, if you will. Selling more chips doesn’t necessarily mean those chips will be used to profitable ends, in fact the more chips are purchased, the more revenue the buyers have to generate down the line in order to generate profit. So this is anywhere from neutral to supporting the idea of an AI bubble, depending on the extent to which you buy the idea that no one could possibly need that many chips and foundational AI purveyors are likely overbuilding.

It’s also important to distinguish between an ‘AI bubble’ from a stock/investment standpoint and an ‘AI bubble’ from a business use case standpoint. There has already been a business reality check around which use cases for AI are ROI-positive, and I expect that refinement to continue, as it always does for new technologies. This is good and healthy as the discipline matures. I also expect costs of AI tools for businesses to increase over time (this is normal for a category creation product), which will further force investment in only those initiatives that make business sense, which is as it should be. Those moments of reckless abandon don’t last long. All of that said, AI is absolutely here to stay. For the right use case, it’s just too valuable and too great a leap forward for businesses not to continue to invest. Use cases such as empowering customer service agents with thoughtful, nuanced responses and using AI for document summarization and anomaly detection come to mind. I think in a few years it will be just like any other technology we’re used to having: you evaluate it for the use case, and deploy it where it makes sense.

And that business value means that ultimately I don’t think we’ll see a massive stock implosion either. There will be peaks and valleys of course, some weaker players will be forced out, and some of the fevered rush to put AI in everything will calm down, just like the app boom did a dozen or so years ago. That’ll likely cause corrections as demand contracts toward the use cases that provide positive ROI and oversupply has to be reeled back in. This vibration in the market tends to weed out less-sound players who leapt on the bandwagon without a real value proposition. This will likely lead to some bumpiness in the market over the next few years and is all normal maneuvering when a new category is created in tech.

Should you be cheering for an AI bubble?

In some circles, I hear the idea of an AI bubble discussed almost gleefully, as though the person is hoping it comes to pass. My unproven theory is that this is coming from an underlying discomfort with AI itself, and hoping it’s a passing fad.

As we’ve already covered, while some degree of bubbly behavior is likely for stocks in the short term, along with recalibration of certain business use cases and expectations, AI is not, as a whole, a temporary fixation. This means rooting for a bubble doesn’t mean the new tech goes away—a bubble would cause some financial instability for certain individuals and companies, and possibly some spillover effects in the broader financial market, but it wouldn’t eradicate AI from our lives. The potential wins (and some already-achieved wins) are just too seductive. Therefore, cheering for a bubble is mostly cheering for chaos. Fine if that’s your vibe, but probably not actually beneficial to most individuals and businesses.

I’ve also heard the argument that an AI bubble is going to save us from massive job losses to AI. This isn’t quite how it would be likely to go down. That argument is assuming that the demand side for AI to replace jobs is there, but the supply side would be completely taken out by bubble dynamics. Because there are already multiple players, it would have to be such a catastrophic bubble as to take out all players (and prevent new ones from buying their assets and taking their place). Otherwise, the proven demand and potential revenue will keep spawning new companies.

The kind of complete dismantling of the supply side that we’re talking about here would require a dramatic outside force such as the government outlawing AI. I haven’t heard any credible evidence to suggest that would happen.

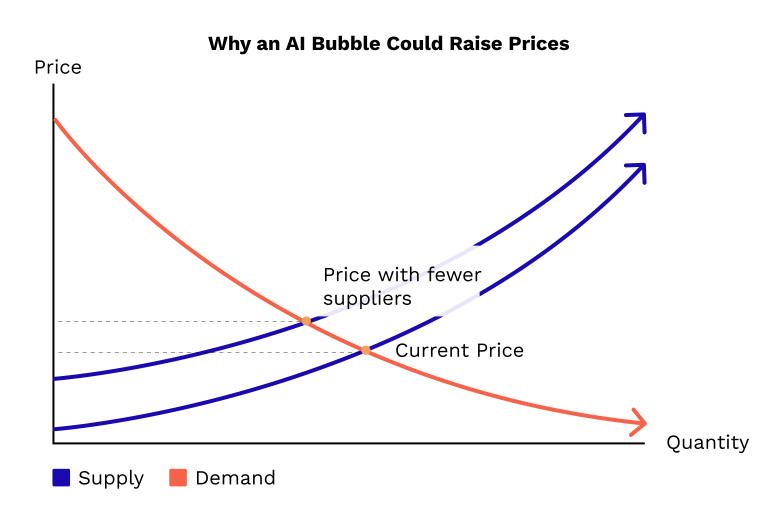

I mentioned that it would have to be a complete dismantling of the supply side to eradicate AI. That’s true, but there would still be some effects that are harmful for AI consumers from the elimination of market players. We’ve all heard that competition keeps costs down, and the laws of supply and demand are the reason for that. Where supply and demand meet, we get our free market price. If supply is reduced temporarily, costs also rise temporarily. Not enough to kill off AI as a tool, but possibly enough to cause some consternation for businesses and individuals.

The other problem with the jobs argument is the assumption that the demand side for AI to replace jobs is already here. Outside of some very isolated pockets. I’d wager most of the job cuts we’ve seen this fall weren’t because AI was good enough to replace people, but it may have been influenced by companies overspending on AI and needing to cut in other areas. Same result, different causation. Today’s AI is most likely to shift people’s work—for example, from directly writing to prompting and reviewing—but not eliminate it.

Ultimately AI provides legitimate business value for the right use cases, and the companies staying clear-eyed about what creates return for business customers will get their pricing and cost structures in line and ultimately come out on top. But that doesn’t mean we won’t see some smaller-scale bubble dynamics in the near term. It’s possible to be both an AI optimist and a market realist.